Captive Fronting

Fronting Basics Frontingbasics

A fronting arrangement is where a captive cuts a deal with a fully-licensed insurance company (the fronting carrier or simply front) for it to sell insurance to parties that are not closely affiliated with the captive, but the captive takes over the risks and earns the premiums, less a fronting fee.

It will be recalled that captive insurance companies have restricted insurance licenses that limits the captive to conducting the business of insurance with only parties that are a closely affiliated with the captive, usually meaning other operating subsidiaries of the same parent organization. There is an important loophole to this license restriction, however, which is that captives can sell insurance to another insurance company and take on the risks of that other insurance company for a fee -- this is known as reinsurance.

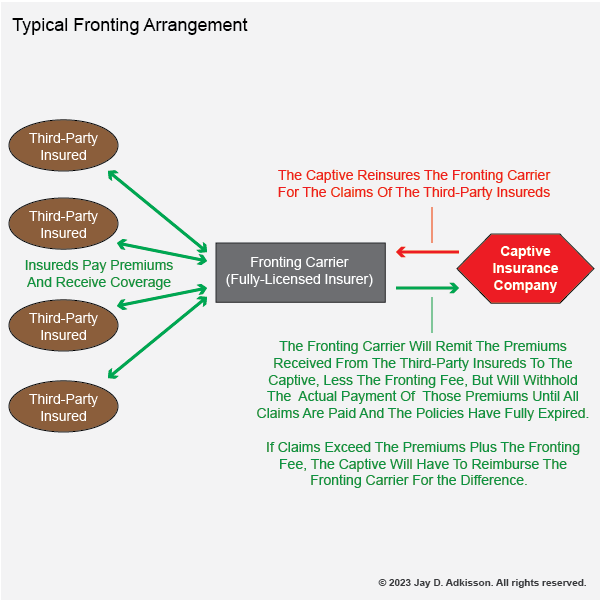

What the captive can do then is to cut a deal with a fronting carrier (one that is licensed to sell particular lines of insurance to the general public), whereby the fronting carrier sells insurance policies to the non-affiliated parties, but the reinsures ("cedes") the risks and the premiums from that insurance to the captive by way of the captive reinsuring the fronting carrier for those policies and risks. Thus, the risks and premiums pass to the captive, less the fee charged by the fronting carrier (the fronting fee). The effect is that the captive is now selling insurance to unaffiliated parties, albeit indirectly.

Folks sometimes look at this arrangement and conclude that the fronting carrier is essentially just renting out its broader license authority to the captive for a fee. In some sense, that is correct, but in others it is not. Importantly, because only the fronting carrier can sell insurance to the non-affiliated parties, the fronting carrier must deal directly with the non-affiliated parties and is directly liable to them for policy liability. It doesn't matter if the captive pays or not on its reinsurance contract, the fronting carrier will still have to pay.

To protect itself against non-payment of claims by the reinsuring captive, a fronting company will ordinarily withhold the premiums to be paid to the reinsuring captive until all the claims have been paid and the policies have expired. This is known as premiums withheld reinsurance or funds withheld reinsurance and is very common in fronting deals. Additionally, the fronting carrier may also require that the reinsuring captive also post an irrevocable letter of credit (an "ILOC") to protect the fronting carrier against losses.

All of this is illustrated by the following diagram:

Fronting arrangements are very often used for workers compensation and other employee benefits. Employees are not sufficiently affiliated with their employer's captive such that the captive can underwrite workers compensation policies. Thus, fronting arrangements are commonly used.

For example, XYZ Corporation employs 800 workers and is being charged high premiums because it is categorized with other similar employers with high claims rates, even though XYZ Corporation has invested a lot in safety and its claims are substantially lower. Thus, XYZ Corporation has its captive enter into a fronting arrangement through DEF Insurance, a large workers compensation carrier, by which DEF Insurance will issue workers compensation policies for XYZ's workers, but then through a reinsurance contract cede all of the risks and premiums for those workers compensation policies to XYZ's captive. For this accommodation, DEF Insurance will charge a fronting fee equal to 7% of the total premiums received for the workers compensation policies. However, DEF Insurance Company will not actually remit the premiums to XYZ's captive until all claims have been resolved and the policies ended. Additionally, should the claims exceed the premiums (plus the fronting fee), XYZ's captive will have to pay money to DEF Insurance to make it whole.

In this scenario, there are two variants that relate to who administers the claims. In the first variant, DEF Insurance itself administers the claims using its in-house staff for this purpose, who then add the cost of their services to the claims expense. In the second variant, XYZ's captive takes over claims administration and hires a third-party administrator ("TPA") for this purpose.

Note that fronting arrangements are usually limited to very substantial transactions, because it is not worth a fronting carrier's time to be involved with small matters. With workers compensation, for example, most fronting arrangements require at least 500 employees at a minimum.

Notably, in the early days of captives when I was around, it was like pulling teeth to talk the large commercial carriers into doing fronting deals. Eventually, they figured out that fronting was an excellent profit center with hardly any risk (basically "free money") and thus these days nearly all major carriers have fronting desks that do little more than cut fronting deals.