Reinsurance Basics

Reinsurance Basics Reinsurancebasics

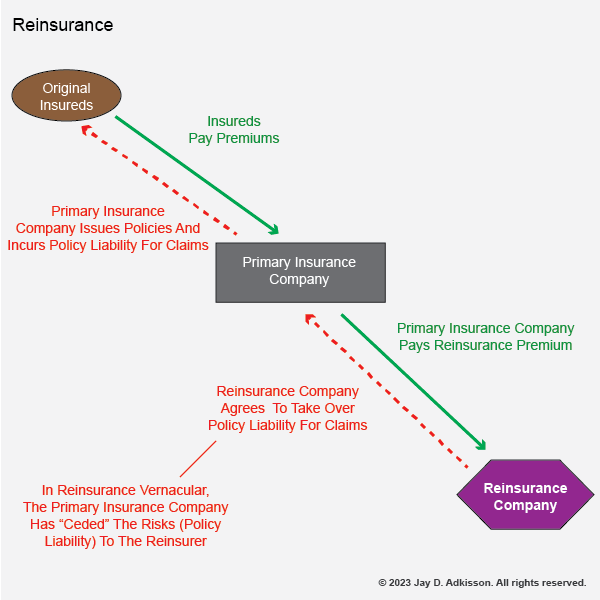

Reinsurance is a simple concept in essence: One insurance company (the reinsured) itself purchases insurance from another insurance company (the reinsurer) so as to protect the reinsured insurance company from some or all of the risk exposure that it has from the policies that it has sold to customers. The reinsurer insurance company takes on this risk in exchange for a reinsurance premium paid by the reinsured insurance company to the reinsurer insurance company. This is all accomplished by way of a reinsurance contract that is sometimes referred to as a reinsurance treaty. The following diagram illustrates all this:

Reinsurance arrangements are very common between so-called "retail" insurance companies, which sell to the general public, and the numerous very large reinsurance companies globally. By transferring risks to a reinsurance company, the retail company may move those risks off its own books and thus underwrite even more insurance business without having to set aside large reserves.

It is likewise common for reinsurance companies to themselves purchase reinsurance and thereby transfer portions of their risk exposure to other reinsurance company. Thus, a grocery store in Salina, Kansas, might have its liability risk passed from its retail insurance company to another reinsurance company, and then further passed on several times by way of successive reinsurance agreements, with the risk ultimately landing as part of a bundle of transferred risks in Bermuda or Switzerland. In this sense, insurance risks are thus bundled and reinsured similarly to how home mortgage-backed securities are handled.

Reinsurance is an integral part of the captive insurance landscape, and is primarily utilized in connection with captives two ways:

- Captives may purchase reinsurance and thus lay off significant portions of their risk to larger reinsurance companies that have the capital and reserves which can better accommodate those risks, as opposed to a captive which may have relatively little capital and reserves.

- Captives may themselves act as reinsurers as part of a fronting arrangement which indirectly allows them to sell insurance to non-affliated parties, something that their restricted captive license does not ordinarily permit.

Note that a captive wishing to purchase reinsurance may face a substantial barrier to entry to the reinsurance markets, however, which is that reinsurance companies are usually not interested in smallish reinsurance deals. Rare is the reinsurance contract that has a premium less than $1 million. Reinsurance companies that will accept a smaller reinsurance premium than $1 million are too often sketchy, unrated, fly-by-night operations based in poorly-regulated (if regulated at all in any meaningful sense) jurisdictions, and may not be able or willing to pay if there is a significant loss.