Adkisson's Captive Insurance Companies

HomePage

This website presents a discussion of captive insurance and related issues by Jay D. Adkisson, an attorney who practices litigation in this sector and was the first Chair of the American Bar Association's Committee on Captive Insurance.

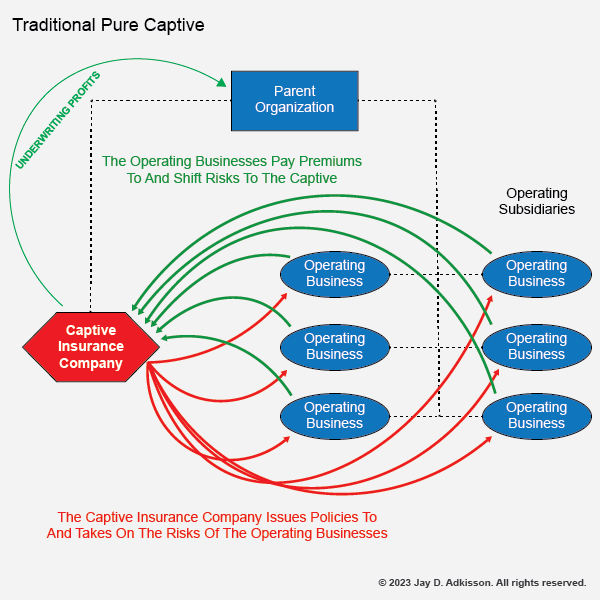

Fundamentally, a Captive Insurance Company (known simply as a "captive") is an insurance company that is owned by some parent organization, and which is used by that parent organization to underwrite the insurance needs of its operating subsidiaries. The captive may replace some or all of the organization's existing third-party commercial insurance coverages, and it may offer insurance coverages that are otherwise unavailable or unaffordable in the normal commercial insurance markets.

A captive is usually distinguished from an ordinary insurance company by its license: A captive has a restricted license that closely limits to whom it can sell insurance, usually being limited to the organization of which it is a part. A captive does not have an "unlimited license" (sometimes referred to as a Class A License) of a major commercial insurance company that would allow it to sell insurance to the general public or to others not somehow closely affiliated with the captive.

The primordial variant of a captive insurance company is the so-called Pure Captive in which the captive's insurance business is restricted to that of the organization of which it is a part. This is illustrated by the following diagram:

Captives offer at least the following significant benefits:

- Reduction Of Organizational Insurance Costs. Captives allow the organization to retain underwriting profits that otherwise would have been lost to third-party commercial insurers. This usually to very substantial overall insurance cost-savings for the overall organization.

- Enable Direct Access To Reinsurance Markets. Most commercial "retail" insurance companies do not themselves retain much risk, but instead they pass the risk off to even larger reinsurance companies, with their profit being what they received from their insurance customers less what they paid for a reinsurance policy. A captive allows an organization to essentially "bypass the middleman" (the "retail" carrier) and access the reinsurance markets directly for lower cost policies.

- Insure Risks That Are Otherwise Uncoverable. Captives allow an organization to provide insurance coverage for risks that may be either uninsurable within the commercial markets, or the cost of such insurance is not reasonably affordable to the organization. The captive allows the organization to reserve against those risks, which reduces the organization's exposure to risks for which it is otherwise unprepared.

- Incentivize Better Organizational Risk Management Practices. Because the reserving against risks has been internalized within the organization, thus affecting the organization's bottom line, the organization becomes incentivized to better manage its operations in such a way to reduce claims made or losses incurred. This is very different than simply purchasing a commercial third-party insurance policy and relying solely upon it for the totality of claim and loss recovery.

- Open A Pathway To The Business Of Insurance. Over time, many captives have gone on to become fully-licensed insurance companies which then began to offer insurance outside the organization to the general public, thus creating an additional profitable business asset for the organization.

There is no free lunch, of course, and the availability of captive insurance as a tool for smaller businesses is subject to these barriers to entry:

- Captives Are Expensive. The typical minimum cost to form a captive insurance company is rarely less than $50,000 and the combined maintenance costs (including licensing fees, actuarial fees, underwriting fees, audit and tax preparation fees, etc.) will similarly rarely be less than $50,000 per year. All of this is exclusive of claims-handling fees and costs.

- Captives Require Substantial Capital And Reserves. Captives require a great deal of capital, usually at least $250,000 statutory minimum capital but often greater, and must keep very substantial reserves against potential policy liabilities. These reserves must be held in the captive, and usually in very low-risk and conservative investments, and thus are unable to be otherwise deployed by the organization into investments that generate higher returns.

- Captives are Exposed To The Risks They Insure. The one thing that a captive absolutely cannot do is to magically turn a bad risk into a good one. Bad risks are better not being retained and instead should be transferred to others willing to take them on, if such is affordable by the organization. Note, however, and as described above, a captive may be able to perform this type of risk transfer more cheaply by direct access to the reinsurance marketplace.

Finally, a captive is a risk management tool, and not a tax shelter?. Many folks who have attempted to use captives as a tax shelter have paid significant fines and penalties, particularly for so-called microcaptive shelters?. If there are tax benefits that accrue to the benefit of a particular captive, those benefits must be no more than incidental to its proper operation.

The purpose of this website is to elucidate many of the basic concepts of captives and their now many varietals, as well as ordinary issues that arise with regard to captives.

Enjoy!