Micro-Captive Tax Shelters

Microcaptiveshelter Microcaptiveshelter Microcaptiveshelter

Introduction

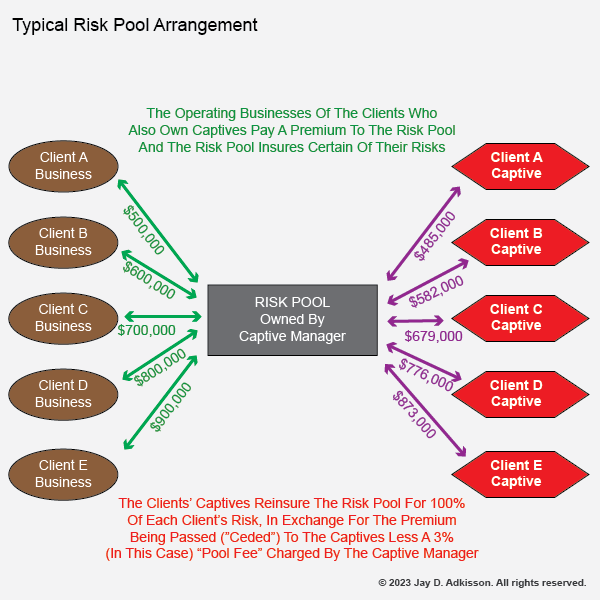

A microcaptive tax shelter is typically a captive that has made an election to qualify under Internal Revenue Code section 831(b), and which typically attempts to use a risk pool controlled by the captive manager to meet the tax law requirements for risk shifting and risk distribution. There are many variations to risk pools, but the idea for a tax shelter captive is the same: The operating business owned by the client pays a premium for insurance to the risk pool, and then the risk pool enters into a reinsurance agreement with the client's captive insurance company, whereby for the same premium (less a small "pool fee" charged by the captive manager, usually 3% to 6%) the client's captive effective takes over all the insurance risk from the risk pool for the client's operating business.

Some money goes in, same money goes out. Same risk goes in, same risk comes out. Where is the risk shifting? Where is the risk distribution? There isn't any, and thus there is no risk distribution. The typical risk pool arrangement is shown below:

To try to avoid that result, the captive managers will attempt to structure their risk pools so that they appear to take on risk, such as taking on a layer of claims between $1 million and $1.1 million that is unlikely to materialize. However, the captive manager doesn't want to lose money, not matter how long the odds, and so usually these deals will have "backdoor" arrangements with the client to protect against such losses, such as by requiring a retroactive assessment of premiums to make the risk pool whole. Of course, these methods eliminate even the pretense of any risk shifting as well. Similarly, one client doesn't want to actually be exposed to the losses of another client, so the documents for the risk pools are crafted to prevent that result and thus assure clients that the only losses from the risk pool will be their own.

While risk pools are often legitimate and are widely used in insurance, these sorts of pools are simply a sham that a designed to create the appearance of risk shifting and risk distribution without either of those things actually happening. That is why captives in these arrangements are considered to be tax shelters, and not bona fide captive insurance companies.