Risk Layers

Risk_Layers Basics Risklayers

The policyholder of an insurance policy typically sees only the insurance company that sold the policy. The policyholder sends the insurance company the premium, and the insurance company returns the policy. If there is a claim the insurance company will handle it with the policyholder simply paying the deductible. This is all that is seen from the policyholder's viewpoint. Behind the scenes, however, there is a lot more going on. This brings us to the concept of risk-layers and risk-layering, which describes who has the financial responsibility for claims made and how they came to have that responsibility.

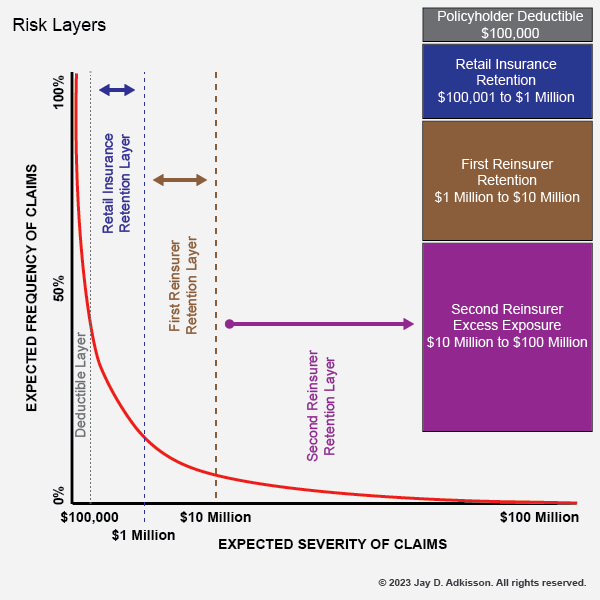

The following illustration is of a very typical risk-layering of an insurance policy, and we will use it to further explore these issues.

The above illustration is for a policy that covers a particular risk up to $100 million aggregate of claims.

Policyholder. The policyholder has a $100,000 deductible, meaning that the policy will not start paying claims until the claims exceed $100,000. Deductibles exist to keep the insurance company from having to handle relatively minor claims that the policyholder should itself be able to comfortably resolve. Only once the claims have exceeded $100,000 will the policy liability kick in.

Insurance Company. The insurance company has sold a policy that creates a liability for an aggregate of claims beginning at $100,000 to $100 million. Actuaries have calculated that there is a 40% chance of having the claims exceed $100,000 but there is a chance, albeit minute, that the claims may reach the policy limit of $100 million. The insurance company, however, does not want to take on so much risk. Therefore, the insurance company enters in a reinsurance contract with the First Reinsurer (reinsurance company) whereby the First Reinsurer, in exchange for its own premium, will take on all policy liability over $1 million.

First Reinsurer. The first reinsurance company now has all liability for the aggregate of claims over $1 million up to $100 million. The actuaries have calculated that there is only a 10% chance that claims will exceed $1 million. However, the first reinsurer also does not want exposure up to $100 million, so therefore it enters into a reinsurance contract with the second reinsurer to take the liability over $10 million off its hands.

Second Reinsurer. In exchange for the reinsurance paid by the first reinsurer, the second reinsurer now takes on the claim liability over $10 million and up to the policy limits of $100 million. Actuaries have calculated that there is only a 3% chance that the claims will exceed $10 million.

In each event, appropriate premiums will be charged for the risks each party is taking on. The insurance company will charge a premium that will be sufficient for its own risk and to pay a premium to the first reinsurer, and the first insurer will charge a premium that will be sufficient for its own risk and to pay a premium to the second reinsurer.

Although the risk cascades down through all these parties, typically only the insurance company that sells the initial policy will actually administer the claims. When the claims exceed each attachment point (the amount of claims where a new party begins to take on liability) the insurance company will demand that the reinsurers remit sufficient funds to cover the claims as appropriate.